does cash app report personal accounts to irs

Personal Cash App accounts are exempt from the new. Tax Reporting for Cash App.

Will Users Pay Taxes On Venmo Cash App Transactions It Depends

Does Cash App report personal accounts to IRS 2021.

. For this reason it is recommended that you set up separate cash apps for business and personal use. Certain Cash App accounts will receive tax forms for the 2021 tax year. The new cash app regulation isnt a new tax.

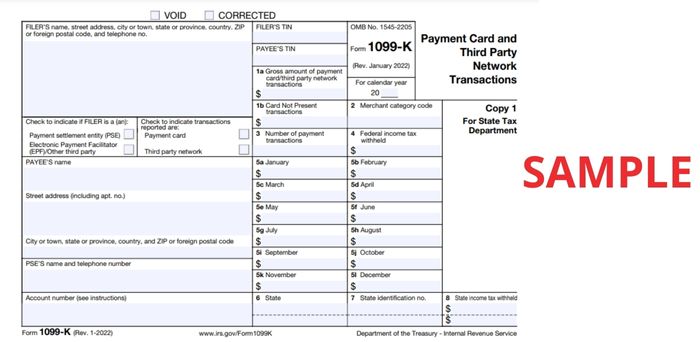

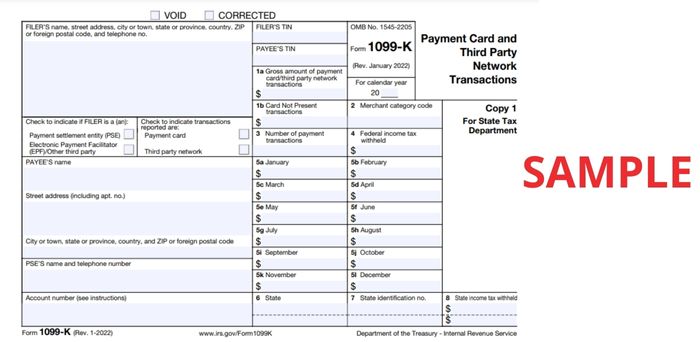

Does Cash App report personal accounts to IRS. The reporting threshold for Form 1099-K changed from a gross payment threshold of 20000 with more than 200 individual third party network transactions. Log in to your Cash App Dashboard on web to download your forms.

Now cash apps are required to report payments totaling more than 600 for goods and services. Payments for goods and services totaling 600 or more in a year must be reported on Form 1099-K starting January 1 2022. A seller would only need to report income to the IRS if they had received 20000 worth of payments per year and there were at least 200 transactions on their account.

As of January 1 2022 there are new rules for cash apps and electronic payment systems to report business transactions to the IRS. Previous rules for third-party payment systems. Beginning this year Cash app networks are.

Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the IRS. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these.

What Is Cash App Tax 2022 When Cash App Reports To Irs

Irs Reports Transactions From Venmo Cash App Pay Pal More Wfmynews2 Com

Does Cash App Report Your Personal Account To Irs

New Irs Rules For Cash App Transactions Start Next Year Wfmynews2 Com

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc7 New York

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

No Venmo Isn T Going To Tax You If You Receive More Than 600 Mashable

Does Cash App Report Your Personal Account To Irs

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/7XQSQOTTARBLLM3GALGXEIPZEY.jpg)

Venmo Paypal Cash App Must Report Payments Of 600 Or More To Irs Kiro 7 News Seattle

Venmo Cashapp And Other Payment Apps Face New Tax Reporting Rule Cnn Business

Tax Reporting For Cash App For Business Accounts And Accounts With A Bitcoin Balance

Do You Have To Report Cash App Payments To The Irs Engineer Your Finances

There S A New Tax Rule For Us Small Business Owners What To Make Of It Us Small Business The Guardian

Is The Irs Taxing Paypal Venmo Zelle Or Cash App Transactions Here S What You Need To Know

Cash App Taxes 100 Free Tax Filing For Federal State

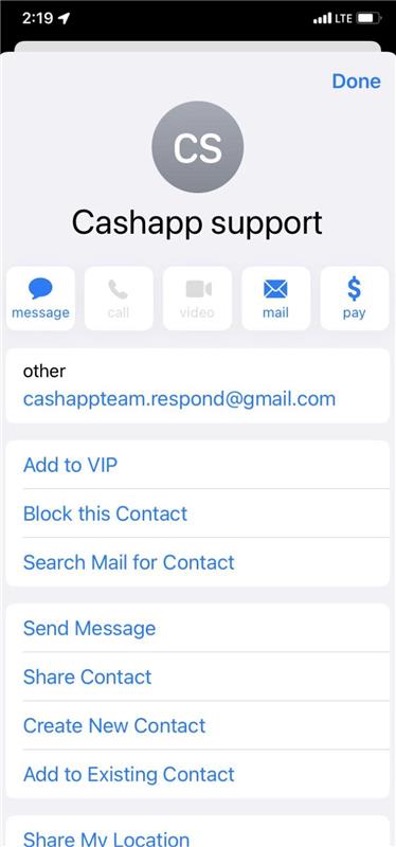

Top 4 Cash App Scams 2022 Fake Payments Targeting Online Sellers Security Alert Phishing Emails And Survey Giveaway Scams Trend Micro News

Is The Irs Taxing Paypal Venmo Zelle Or Cash App Transactions Here S What You Need To Know

Irs Reports Transactions From Venmo Cash App Pay Pal More Wfmynews2 Com

Cash App Tax Forms All Tax Reporting Information With Cash App