capital gains tax news in india

Wed Jan 26 2022. Capital gains tax.

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Capital gains arising from the transfer or sales of assets located in India realized through the transfer of shares of a foreign company that is an indirect transfer.

. Indonesia plans to charge value-added tax VAT on crypto asset transactions and an income tax on capital gains from such investments at 01 percent each starting from May 1 a tax official said. Check out for the latest news on capital gains tax along with capital gains tax live news at Times of India. Like other types of taxes corporate tax be it domestic or foreign is also an essential tax that the corporate house must pay yearly.

The calculation of indexed cost can be. Bloomberg Jan 22 2020 1448 IST Removal of the long-term capital gains tax and measures to boost consumption are high on equity investors wish list from the Union Budget. From the Income Tax Slabs The 30 Tax is applicable for an annual income of more than Rs.

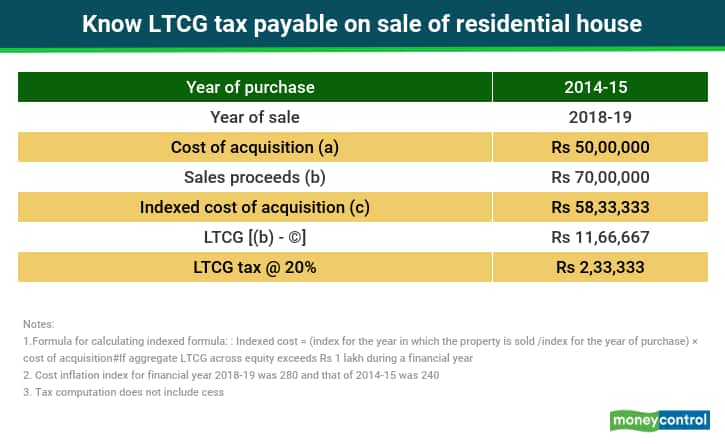

The following table highlights the assets in respect of which the benefit of re-investment is available. Short Term Capital Gain Rs. Long term capital gain sale consideration indexed cost of acquisition- indexed cost of the improvement if any-expenses incurred exclusively for the sale of the asset-exemption us 54 54F 54EC if any availed.

We will briefly learn about what. The capital gains tax in India under Union Budget 2018 10 tax is applicable on the LTCG on sale of listed securities above Rs1lakh and the STCG are taxed at 15. Read more on capital gains tax.

Now since there are different types of capital assets the Indian Tax Act also has several sections. Tax liability on these assets depends on the duration for which the property was held by the seller and is calculated under the head Capital Gains. A taxpayer can claim exemption from certain capital gains by re-investing the amount of capital gain into specified asset.

Income Tax April 10 2022 0 comments 63 views. Indias economic recovery progressing well says Aditya Birla Group Chairman Kumar Mangalam Birla. Long-term capital gain from listed equity shares of more than 1 lakh attracts a 10 tax without.

ALSO READ ITR filing. How to pay your income tax using Challan 280. Various corporate tax rates in India are categorised as per the types of corporate houses.

Read capital gains tax Latest News also find Videos Photos and information about capital gains tax from ZeeBizCOM. The STCGs on debt MF are added to the income of the taxpayer and is taxed according. The tax implications in case of sale of residential property in India by a non-resident is same as that for a resident individual ie.

Tags Short Term Capital Gains Tax. Akin to Section 112A Section 111A specifies the rate of capital gain tax to be 15 plus applicable surcharge and cess. The tax laws in India are very comprehensive.

There are different sections and provisions in the Indian Tax Act that define taxation policy on different types of income. Apple iPhone 14 iPhone 14 Max iPhone 14 Pro iPhone 14 Pro Max - Check. IStock 3 min read.

With the economy. Get latest Capital Gains news updates stories. In the post-Budget interaction Revenue Secretary Tarun Bajaj said that the Government Clears Air Around Capital Gains Tax.

Adding short Term Capital Gain into the Annual Income Rs. Capital gains are classified into two categories long-term capital gains and short-term capital gains. ITR filing for FY 2021-22.

For example you will have to pay long term capital gain tax on sale of property held for more than 2 years. In certain assets such as property short-term capital gain is taxed as per the income tax slab. The KPMG member firm in India has prepared reports about the following tax developments read more at the hyperlinks provided below.

950000 Rs 500000 Rs. Short Term Capital Gains Tax. Capital Gains Tax in India.

Therefore Short Term Capital Gain Tax 30 of Rs. Besides this the both long term and short term capital gains are taxable in case of debt mutual funds. One such tax is capital gain tax levied on capital gains made by individuals.

Taxation Exemptions in India. Proposal concerning indirect transfer-related provisions. Tax is also applicable on the interest received from the bond what is the tax calculation on which bond know the details - Advertisment -.

Income tax Wealth tax and capital gains are some of the essential taxes customers pay annually in India. 2 days agoSo the formula is. Finance Minstry Likely to Scrap Dividend Distribution Tax.

1 day agoThe proposal called the billionaires minimum income tax would require that taxpayers worth more than 100 million pay a minimum of 20 on their capital gains each year regardless of whether. Long term capital gain will be levied if the property has been hold for two years or more.

How To Save Capital Gain Tax On Sale Of Residential Property

How To Save Capital Gain Tax On Sale Of Residential Property

Mutual Funds Taxation Rules Fy 2020 21 Capital Gains Dividends

The Long And Short Of Capitals Gains Tax

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

The Long And Short Of Capitals Gains Tax

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Mutual Funds Taxation Rules Fy 2020 21 Capital Gains Dividends

Taxation Laws Indiataxation Long Term Capital Gain And Long Term Capital Gain Exemption How To Memorize Things Business Tax Deductions Capital Gain

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Capital Gains Tax

The Long And Short Of Capitals Gains Tax

Long Term Capital Gain On Property Owner Critical Things To Know

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe